With a diversity of available technologies and resources to help our economy decarbonize, we need to leverage resources from various locations and economic activities, maximize our carbon reduction capacity, and ensure we aren’t leaving savings on the table.

Hydrogen is a powerful piece of the energy transition puzzle as we move forward to a carbon neutral or carbon negative economy. Hydrogen has the ability to replace traditional fossil fuels, like diesel and coal, and it is ideally situated to decarbonize several hard-to-electrify sectors, including heavy industrial and transportation markets. When paired with renewable energy inputs for the hydrogen production process – specifically Renewable Natural Gas (RNG) – we can cost-effectively produce zero net carbon hydrogen. The ability to use RNG from various types of sources and locations is the key to unlocking a substantial and growing renewable resource across the United States.What is RNG

RNG is chemically identical to fossil natural gas and is primarily composed of methane (CH4). RNG is sourced from various organic or “biogenic” waste resources that would otherwise decompose and release methane into the atmosphere. Since fugitive methane in the atmosphere has a high global warming potential (GWP) compared to carbon dioxide (CO2), reducing human-caused methane emissions is essential. The ability to capture and avoid these methane emissions allows RNG to provide significant carbon reductions. Certain types of RNG can even achieve a valuable negative carbon intensity.

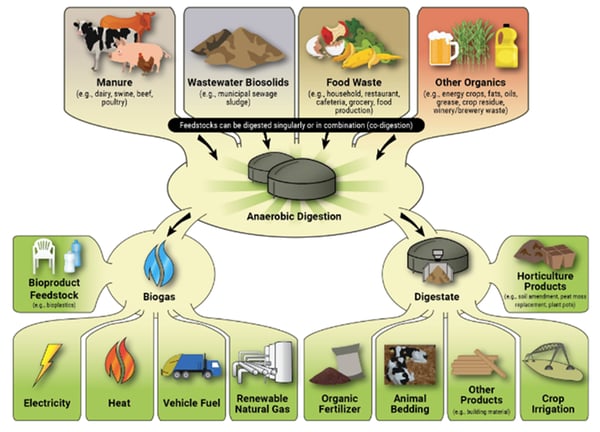

Where does RNG come from?

Common sources of RNG include animal manure, wastewater biosolids, food waste, organic waste from agriculture, and landfills.

(source: US EPA)

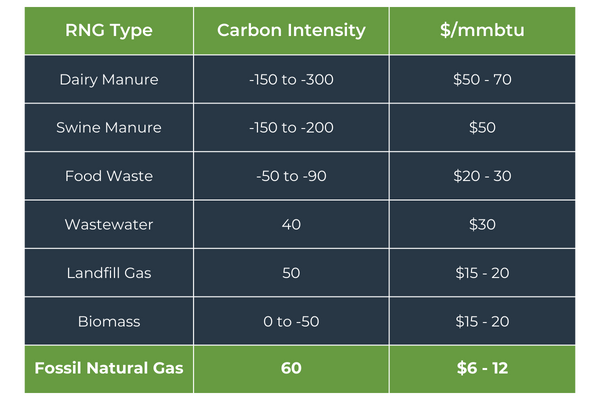

Relative Carbon Intensity of RNG Sources

The relative carbon intensity of different types of RNG is shown below, with representative costs on an MMBtu (million British thermal units) basis. Carbon Intensity (CI) values shown here are a representation of the carbon content (grams of CO2 equivalent) per unit of available energy (MJ, or megajoules). Individual RNG sources are assessed and documented according to the energy input and cumulative carbon value associated with producing that energy source. These initial assessments, and regular auditing by third parties ensure actual carbon emission reductions.

The cost of these respective RNG types reflects market demand for lower (i.e., negative) CI values for RNG feedstock and the potential incentive value for that low CI score fuel under national and state incentive programs (National EPA Renewable Fuel Standard, and the California Low Carbon Fuel Standard).

Book and Claim Basics

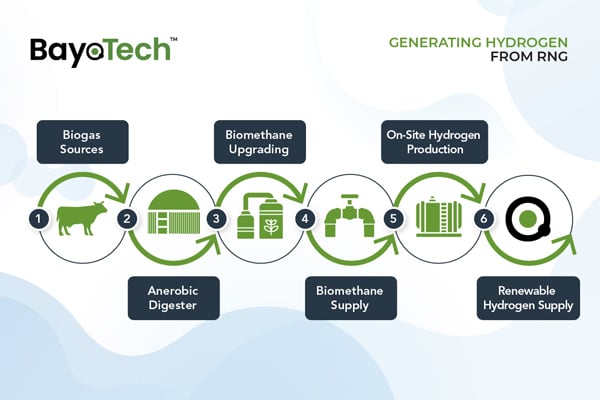

RNG is a critical tool in decarbonizing hydrogen production. Using the Book and Claim accounting method, we can take advantage of RNG produced in areas with established production sites while still providing low-cost, low-carbon hydrogen in regions that don’t have that option. Understanding Book and Claim as part of the larger production value chain, we can envision a relatively simple series of steps.

- Biogas Sources – In this example, we can imagine a dairy farm in Wisconsin with large amounts of cow manure. This manure would normally decompose and produce fugitive methane.

- Anaerobic Digester – The waste material is collected into a digester, and the decomposition is accelerated. The biogas, or “raw” RNG, is collected instead of escaping to the atmosphere.

- Biomethane Upgrading – The biogas is purified to be chemically identical to pipeline natural gas.

- Biomethane Supply – The RNG commodity (physical gas) is injected into the local gas utility pipeline. At the same time, the environmental attributes (EAs), or avoided carbon emission, are contractually separated from the physical gas molecules.

- On-Site Hydrogen Production – Meanwhile, potentially thousands of miles away, hydrogen production can contract for those same RNG environmental attributes (EAs). The (avoided) carbon value of those EAs effectively offsets the use of pipeline natural gas.

- Renewable Hydrogen Supply – Low-carbon hydrogen is produced locally. The carbon intensity of the hydrogen is established and documented based on the use of RNG EAs.

Environmental Attributes are currently regulated as part of the creation of incentive credits. The California Air Resources Board (CARB) is the regulatory agency in California that administers the Low Carbon Fuel Standard (LCFS), which is currently the largest market for low carbon hydrogen in the United States (as well as other renewable transportation fuels). To be eligible for the LCFS incentive, hydrogen producers must provide ongoing verification of their production process and supply chain to prove their overall carbon intensity.

In fact, California LCFS is an excellent example of the use of Book and Claim accounting in action. The contractual exchange of EAs (i.e. avoided carbon emissions) with RNG providers is documented and audited on a regular basis by CARB. The LCFS program has succesfully operated since 2011, requiring transportation fuel suppliers to reduce the carbon intensity of the fuels they sell in the state. In 2022 alone, the LCFS program prevented the emission of 14.7 million metric tons of carbon dioxide equivalent (CO2e), which is equivalent to taking 3.3 million cars off the road. The program is expected to prevent the emission of an additional 100 million metric tons of CO2e by 2030.

The market-based program design of LCFS allows fuel suppliers to choose the most cost-effective way to reduce emissions, including the use of Book and Claim accounting for diverse feedstocks and fuel products, including RNG and hydrogen. Accordingly, LCFS is recognized in its flexibility to adapt to new technologies and market conditions, and allowing the transparent tracking and recordkeeping of participants and carbon intensity performance. This has provided strong credibility and confidence in overall outcomes.

Read our blog on “Driving Down Cost Of Clean Hydrogen Production”

Advantages of Book and Claim for RNG

RNG is currently produced across the United States but is concentrated in the Midwest, Northeast, and West (California). Even within these more significant regions, RNG may not be produced near the end user (transportation, hydrogen feedstock, Etc). Using Book and Claim accounting (B&C), BayoTech can contract for the RNG virtually, allowing the Environmental Attributes (EA) connected to the carbon emission reduction to be purchased and reassigned to hydrogen production occurring in an entirely different location.

Book and Claim has several essential benefits:

- Incentivize waste product producers from a wide range of biogenic sources that would otherwise be unable or unwilling to capture fugitive methane to begin collecting RNG for monetization.

- Provides flexibility in procuring RNG across a wide range of locations, carbon intensities, and feedstock types, ensuring flexibility for hydrogen production projects that are just getting started. This flexibility is critical for the growing H2 economy.

- Enables continued capital recovery for existing gas pipeline infrastructure, avoiding long-term utility ratepayer liabilities during the broader national energy transition.

B&C methodology is well established and in use in a number of different markets, including California, Oregon, Colorado, Minnesota, New Hampshire, Oregon, British Columbia, and Quebec, in the operation of their respective low-carbon fuel, renewable gas, and clean heating fuel standards. The documentation and auditing process required to verify the chain of custody has been proven effective under these programs.

What is at stake? Why does this matter right now?

The passage of the Inflation Reduction Act (IRA) of 2022 by the Biden Administration established several significant incentives for renewable energy technologies, including the Section 45V Hydrogen Production Tax Credit (PTC) for clean hydrogen. Under the IRA, Carbon-neutral hydrogen is eligible for up to $3.00 per kilogram, in addition to the California Low Carbon Fuel Standard and other potential incentives at the federal and state levels.

An extensive debate has been ongoing across the hydrogen industry related to the IRA regulatory implementation process and the possible need for targeted restrictions to avoid incentivizing unintended carbon emissions. However, this debate has almost entirely focused on electrolysis and the use of renewable electricity for hydrogen production. Although RNG has been largely a footnote in policy guidance related to this topic, it is a unique and valuable production pathway to carbon free production of energy, apart from electrolysis. With RNG, there are no significant concerns regarding additionality, hourly time matching, or even deliverability, as the gas pipeline system functions differently than the electrical grid. Additionally, the development of smaller SMR production units near industrial and transportation end uses helps to reduce carbon emissions related to long-distance transportation of hydrogen (ie via liquifaction and long-distance diesel based truck transport), and ensures the availability of affordable, carbon neutral hydrogen for both established and emerging end uses as part of the greater energy transition in the United States.

The US Department of the Treasury will ultimately administer the PTC via the IRS as a tax credit program. The draft regulatory guidance is expected in the fall of 2023, a Proposed Notice of Rulemaking by the end of 2023 or early 2024, and a Final Notice of Public Rulemaking later in 2024. Treasury guidance and rulemaking on how to comply and the specific eligibility rules will ultimately determine the trajectory of the hydrogen economy in the US.

We must follow the precedent set by California and others in developing a functional, flexible, and transparent Book and Claim market for RNG under Section 45V of the Inflation Reduction Act. This legislation presents a monumental opportunity to expand on the success of these programs to many additional market sectors and to support the expansion of Renewable Natural Gas for the production of carbon-neutral hydrogen at scale across the United States. Now is the time to ensure hydrogen has the flexibility it needs to grow and evolve with a variety of different production technologies and resources.